Trend Analysis And Future Market Outlook Of Polyaluminum Chloride In 2023

2023 polyaluminum chloride market review

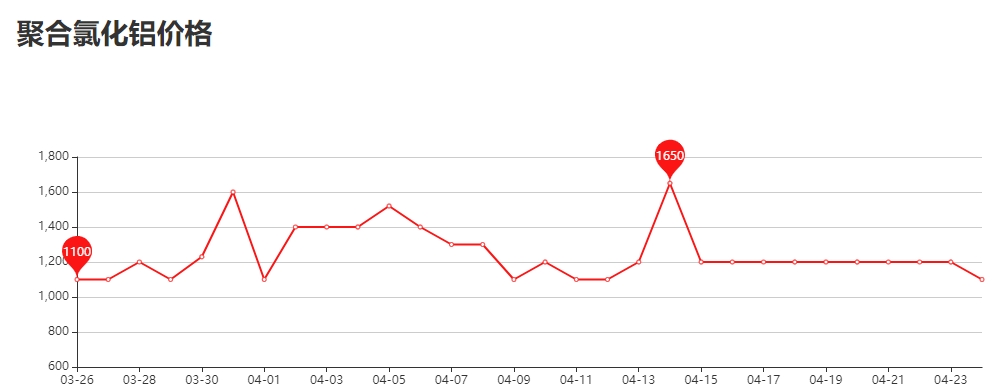

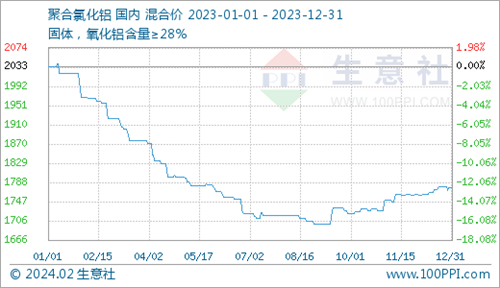

According to the business community commodity market analysis system: 2023 domestic solid (industrial grade, content ≥28%) polyaluminum chloride market average price at the beginning of 2033.75 yuan/ton, at the end of 1777.50 yuan/ton, the annual decline of 12.60%. Among them, the highest point in the year appeared on January 1, 2033.75 yuan/ton, and the lowest point in the year appeared on August 29, 1700.00 yuan/ton, and the maximum amplitude in the year was 16.41%. Polyaluminum chloride market 2023 market high fall.

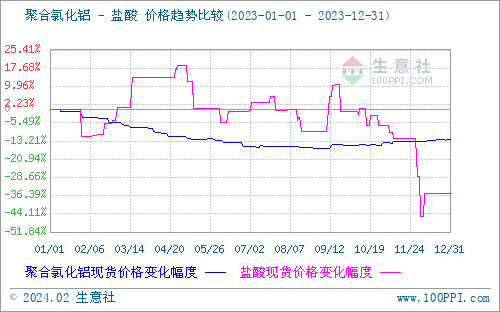

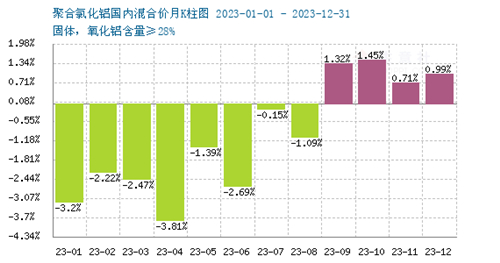

From the business community in 2023 polyaluminum chloride market K histogram data show that in 2023 polyaluminum chloride market fell more and rose less, up in 4 months, down in 8 months. The highest increase was in October, up 1.45%, and the highest decline was in April, down 3.81%.

From January to early September, the polyaluminum chloride market continued to fall, China's main producing areas of water treatment enterprises normal production, sufficient spot inventory, downstream procurement demand is unfavorable, the industry boom is not strong, polyaluminum chloride market continues to be weak. From mid-September to the end of the year, the polyaluminum chloride market picked up slightly, the domestic market oversupply did not change, the polyaluminum chloride market continued to be low, the market procurement enthusiasm has increased, coupled with some raw material prices have rebounded, and the polyaluminum chloride price has risen.

2024 polyaluminum chloride market forecast

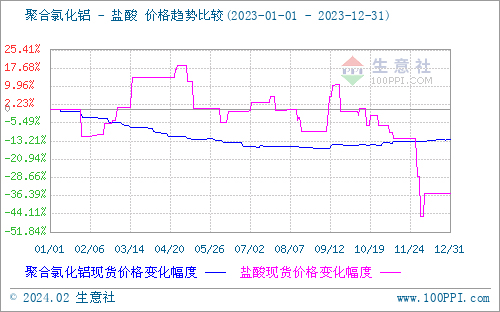

Cost side: According to the commodity market analysis system of the business community, the domestic hydrochloric acid market will fluctuate widely in 2023. The average price at the beginning of the year was 174 yuan/ton, and the average price at the end of the year was 112.50 yuan/ton, a decline of 35.34% for the year. East China is one of the main areas of hydrochloric acid production in China. Among them, Jiangsu Province is one of the important bases of hydrochloric acid production in China, and the production of hydrochloric acid ranks first in the country. In 2024, with the strengthening of environmental protection policies, some hydrochloric acid production enterprises may be forced to stop production or reduce production, and hydrochloric acid production may be reduced.

Supply side: According to incomplete statistics, there are currently more than 300 polyaluminum chloride production enterprises in China, with an annual capacity of more than 300,000 tons (measured by 30% solid alumina content), which is basically used for water treatment. The production capacity of the northern region represented by Henan and Shandong accounts for about 70% of the total domestic production capacity, and the Henan Gongyi region has formed an industrial cluster due to rich raw material resources, with more than 130 local production enterprises, accounting for more than 50% of the total production capacity, playing a leading role in the balance of domestic supply and demand, becoming a typical production base. At the same time, these enterprises set up sales offices in Guangdong and other regions to implement regional structural adjustment of production and consumption. The northern region has gradually become the production base of polyaluminum chloride. Demand in the south continues to grow, becoming the main area of domestic consumption.

Demand side: In addition to the traditional domestic water, industrial water and urban sewage treatment, polyaluminum chloride can also be used for pulp and paper wastewater, pharmaceutical wastewater and printing and dyeing wastewater treatment. By 2023, the number of urban sewage treatment plants in China has exceeded 2,000, with a daily treatment capacity of 170 million cubic meters. At the same time, more and more rural areas have begun to build sewage treatment facilities, further promoting the development of the industry. With the strengthening of people's environmental awareness and the strengthening of national environmental protection supervision, the application scope of polyaluminum chloride in water treatment will be more and more broad, and the development prospect is optimistic.

Future market forecast: At present, China's polyaluminum chloride oversupply, belongs to the buyer's market, the market competition pressure is greater. In 2024, China's polyaluminum chloride inventory is still sufficient; Although there is growth in the demand side of polyaluminum chloride in 2024, the market is still in a state of oversupply, and the overall market of polyaluminum chloride is expected to fall in 2024.

PAC

PAC PFS

PFS Industry News

Industry News Exhibition News

Exhibition News

Send Email

Send Email Phone

Phone